Africa’s financial landscape is evolving rapidly, driven by digitisation and the widespread adoption of mobile banking. With over 1.75 billion registered mobile money accounts in 2023 (GSMA, 2024), Sub-Saharan Africa has the highest levels of global mobile money adoption. This shift has expanded financial access, created new economic opportunities, and accelerated financial inclusion.

However, the growth of digital financial services brings new challenges. Fraud remains a persistent issue, with cybercriminals taking advantage of gaps in identity verification, payment security, and the continued reliance on cash. Every year, fraud costs African banks billions, affecting customer trust and slowing financial inclusion efforts by discouraging digital adoption.

For financial institutions, the challenge is clear: how can they expand financial access while ensuring security? The solution lies in a combined approach – leveraging digitisation to enhance fraud prevention and strengthening financial inclusion to reduce cash dependency and improve transaction transparency.

The Growing Fraud Landscape in Africa

According to the EIB, digital financial services continue to penetrate the African continent. The digital gap has narrowed from 50% in 2021 to 28% by the end of 2024. Mobile money plays a key role in the African economy, being the main driver of financial inclusion and the adoption of new payment methods. According to a 2022 McKinsey fintech report, fintech companies in Africa offer financial services up to 80% cheaper than traditional banks and provide savings interest rates up to three times higher. This growth is driven by factors such as increasing smartphone affordability, expanding internet connectivity, a growing pool of tech talent, a young and tech-savvy population, urbanization, and the shift from an informal to a formal economy. Although mobile banking, digital wallets, and online payments have improved access to financial services, the rapid adoption of new payment methods brings new security challenges.

Identity theft, SIM swap fraud, and unauthorized transactions have become more common, targeting both traditional banks and digital-first fintechs. In Nigeria alone, over 95,000 fraud cases were recorded in 2023, resulting in more than $27 million in financial losses. Many customers remain unaware of digital fraud tactics, making them easy targets for phishing and social engineering scams.

According to the report, “The Anatomy of the New Fraudster”, fraudsters are continuously evolving their tactics to bypass security measures, which highlights the critical need for proactive fraud prevention. However, many financial institutions still rely on fragmented legacy systems that lack real-time fraud monitoring, making it difficult to detect and prevent fraudulent transactions before they occur.

Governments are addressing these challenges by introducing regulations to drive digitalisation and enhance financial security. Such as

- Kenya’s Central Bank introduced mobile money interoperability to enable secure peer-to-peer transactions across different networks.

- Nigeria’s Cashless Policy encourages digital transactions to reduce cash reliance and minimize fraud.

- South Africa has implemented tokenization in eCommerce payments to safeguard customer data.

However, regulation alone cannot keep pace with today’s fraudsters. Fraud is evolving fast and financial institutions must embrace next-generation solutions that incorporate best practices and techniques to stay ahead. Several banks in Africa have already begun modernising. For example, CRDB Bank in Tanzania has strengthen its card management and acquiring capabilities to secure its leading position on the market and promote secure digital payments over cash. Another example is Ethswitch, which created a unified national payment system, connecting all 17 local banks under one interoperable network and enabling instant payments and acquiring services, resulting in over 47% boost of interbank transactions. Meanwhile, Equity bank in Kenya has adopted biometric authentication, GCB bank in Ghana employed advanced analytics to detect fraudulent activities, and NedBank has improved its security through introduction of AI-driven tools.

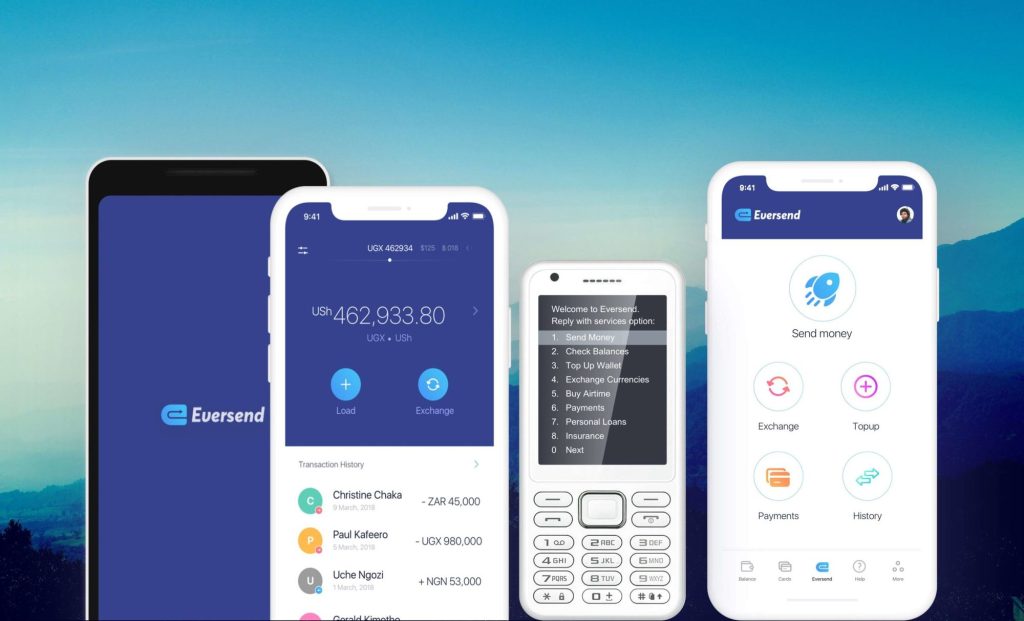

In Africa’s mobile-heavy market, modern fraud prevention as well as digital payment solutions such as mobile banking, e-wallets, SoftPOS for merchants help banks across Africa to improve their security of transactions through the adoption of familiar digital payment methods. These solutions also help drive financial inclusion through the unbanked population.

Building Secure Payment Ecosystems

To drive financial inclusion while ensuring security, banks need to focus on building a unified payment ecosystem that makes digital transactions more accessible and secure. By integrating familiar payment methods such as mobile wallets, instant payments, and digital cards, banks can encourage digital adoption while improving transaction visibility. For example, Somalia Central Bank embarked on a mission to reduce cash transactions nationwide, providing a payment method that is widely acceptable and compatible with the country’s technological landscape. The bank started to build a whole new payment ecosystem through the introduction of QR-payments, enabled by next-generation technology.

Whether closed-loop or open-loop, these ecosystems help reduce fraud by centralizing payment monitoring. When payments are processed through a unified system, financial institutions can detect suspicious activities in real-time, preventing fraud before it happens.

Another prominent example is the digitalisation of Matatu buses in Kenya. Any cash-based fraud was eliminated due to the introduction of contactless fare payments via USSD technology, integrated with mobile wallet M-PESA. By eliminating cash dependency from the process, the system reduced fraud risks and promoted digital onboarding.

How Digitalisation Prevents Fraud

Digitalisation is not only about expanding financial access – it also enhances fraud prevention. By shifting cash transactions to digital payments, financial institutions gain more visibility and control over activities. Unlike cash-based transactions, digital payments leave a footprint, allowing institutions to track transactions in real-time.

This shift enables financial institutions to move from reactive to proactive fraud prevention. Key technologies include:

- Real-time monitoring: modern banking platforms track and flag suspicious transactions instantly.

- Biometric authentication & KYC: secure identity verification reduces fraud risks. For example, Nigeria’s Bank Verification Numbers (BVNs) assigns unique biometric identities to customers, reducing identity theft.

- Al-driven fraud detection: machine learning analyzes transaction patterns in real-time to detect fraud before it occurs.

- Tokenization for secure payments: sensitive data is replaced with unique digital tokens, making stolen data useless to fraudsters.

- Reducing cash dependence: digital wallets, contactless payments, and SoftPOS solutions make transactions more secure.

Africa’s financial sector will continue its rapid digitalisation in 2025, with digital wallets and contactless payments driving economic growth and financial inclusion. However, fraudsters remain a looming threat on the horizon, constantly refining their sophisticated methods and strategies, making proactive fraud prevention more critical than ever.

To build a secure payment ecosystem, banks need to bridge the financial inclusion gap while ensuring transaction security. This means investing in AI-driven fraud prevention, modernizing authentication methods with biometrics, and adopting next-generation payment technology for enhanced security.

Financial institutions that fail to adapt risk not only financial losses but also lose the trust of its customers. Those that prioritize scalable, proactive fraud prevention strategies will be best positioned to protect their end-users while leading Africa’s digital banking transformation.

In conclusion, the solution for Africa’s financial sector lies in embracing digital innovation while maintaining security measures. By focusing on both financial inclusion and fraud prevention, banks can build a secure and inclusive financial environment that supports sustainable economic growth.

Written By:

Grant Truter

Chief Commercial Officer: Business Development and SaaS Operations – MEA